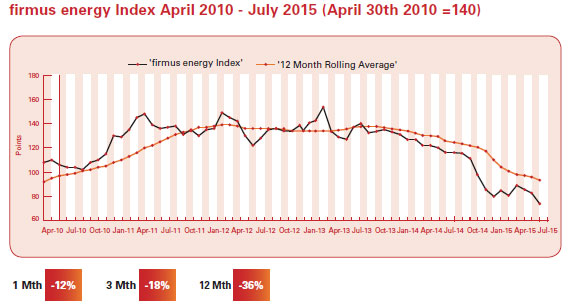

The July 15 firmus Energy Index fell by 12% month-on-month, again due to weaker oil prices. The key to the falling price is that supply is stubbornly abundant.

Summary:

In July 2015 the Index stood at 74, which is the lowest point since the Index was set at 100 on 31 December 2009.

Hot Topic

In July the Chancellor of the Exchequer George Osborne sent shockwaves through the renewables industry when he announced plans to scrap the Climate Change Levy (CCL) exemption for renewable electricity, which aimed to incentivize energy efficiency and reduce emissions. The CCL is an environmental tax on UK businesses’ energy use charged at the time of supply.

Seek renewable sources

However, non-domestic users had the ability to avoid this levy since April 2001 by using electricity from renewable sources. The purpose of the exemption was to encourage business electricity users to seek renewable sources of energy from their suppliers to avoid the levy. From when it was introduced, the levy was frozen at 0.43p/kWh on electricity, 0.15p/kWh on coal and 0.15p/kWh on gas. The chancellor’s changes to the CCL were not welcomed by the Green energy sector. In a statement, the Renewable UK’s director of policy, Gordon Edge, said “The chancellor’s announcement that renewable electricity will no longer be exempt from the Climate Change Levy is a punitive measure for the clean energy sector..and that the..Levy Exemption Certificates generated as a result of the CCL had provided vital financial support for renewable energy producers”. However, the UK Government will welcome the expected revenue boost with the scrapping of the exemption expected to earn the Treasury GBP450 million in 2015-16, climbing up to GBP910 million in 2020-21.

UK Carbon Budget targets

Research firm Bernstein analysts said the removal of the exemption for green power will “effectively reduce the level of support available for existing and future renewable projects in the UK.” The CCL exemption has been described as a key component of the renewable support regime in the UK since 2001 and the phase out was expected to start after 2020. Despite the concerns raised the Green energy sector the UK government has defended its position and has stated that the measure will have no direct impact on the achievement of UK Carbon Budget targets, as emissions from electricity generation are capped through the EU Emissions Trading System.

Sovereign wealth fund

Furthermore, according to the Government, the measure is not expected to impact on the UK’s renewable energy target and that it is on track to meet its ambition for at least 30% of electricity demand to be met by renewable sources. Osborne also promised to bring forward proposals for a sovereign wealth fund for communities that host shale gas developments, to expand the North Sea investment, and cluster area allowances to include additional activities. In contrast to the actions taken by the UK government, US president Obama unveiled the final version of his Clean Power Plan. The plan has three components. One is an EPA regulation that would require a 32 per cent overall reduction in greenhouse gas emitted by existing power plants from 2005 levels by 2025. This will probably lead to the closing of hundreds of plants. The second regulation would require future power plans to produce about half the pollution produced by current plants, effectively ensuring no new coal plants are built in the US. The plan also gives every state a target for reducing emissions and requires each to come up with a plan for how to do it. Amid the shale boom in the US, the green energy sector has something finally to shout about. However, their cousins in the UK may be concerned about the direction being taken by their new government.

Oil

Month-on-month Brent crude oil prices continued to weaken and at US$52.21, the closing price was the lowest recorded by the Bord Gais Energy Index....

Want to read more? firmus energy business customers receive our full index report. Another benefit of switching your energy supply to firmus energy. Why not contact our Key Account Management team today.

firmus energy Index July 2015